Our article last October touched on the dark arts of using complex corporate structures for questionable purposes. Of course, there is much more to the story than that.

Bodies like the OECD, World Trade Organization, and the US Department of Commerce estimate that intra-firm transactions account for between 30% and 40% of global trade.

That can’t all be due to secrecy or tax evasion, surely!

This month we flip the coin and look at an example from the lighter side of intra-company, inter-entity trading, with an enterprise close to our hearts and home.

Orca is Making Waves!

We published several case studies a few years back about Orca Oz Enterprises Ltd, our unreal sister company. We lost touch in 2000 due to COVID, but just found out they have been very busy!

A combination of acquisitions and strategic reorganizations has allowed them to become a major player in the consumer electronics market throughout Australia. Orca’s new multi-company structure, described below, has been designed to optimize efficiency while managing risk, from R&D right through to customer sales and support.

- Orca R&D: This new startup is located in a technology zone on the edge of the Sydney CBD, chosen for its attractiveness to top engineering talent. The hub is responsible for Orca’s product design and development and owns Orca’s product-related IP.

- Orca Manufacturing: This Orca subsidiary, with a factory in a light industrial zone on the northern outskirts of Melbourne, manufactures and assembles components, then packages the finished products ready for retail.

- Orca Distribution: Given Australia’s huge size, Orca has established several regional distribution facilities close to major population centres. This helps them maintain high customer satisfaction levels by reducing shipping times.

- Orca Sales: Orca has staff on the ground in key locations to manage the relationships with Orca’s customers, comprising Australia’s major retail chains. They negotiate and process wholesale orders, which are then fulfilled via the nearest Orca Distribution facility.

Inter-Entity Trade greases the wheels

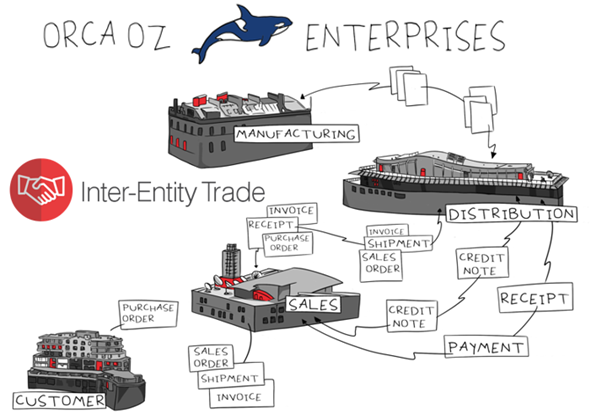

Orca’s expansion has been so rapid that our infographic below is already out of date! That said, it still gives a good representation of those flows that are facilitated by Orchid’s Inter-Entity Trade module for Sage 300,

Here’s a bit more detail about how Orca operates, and the role that Inter-Entity Trade (IET) plays.

- Orca Distribution uses forecasts from Orca Sales to calculate forward stock requirements at each facility. It then shares these with Orca Manufacturing so they can plan their production schedules.

- Orca Distribution enters Purchase Orders as required to maintain their stock levels.

These trigger IET to automatically generate the mirrored O/E Sales Orders in Orca Manufacturing.

- Orca Manufacturing ships and invoices the stock to Orca Distribution.

IET then automatically generates the P/O Receipt & Invoice in Orca Distribution, at the agreed inter-company pricing.

- When a retail customer submits a Purchase Order, Orca Sales enters an O/E Sales Order for that customer.

IET then automatically creates both a Purchase Order to release goods from the nearest distribution facility, and a mirrored O/E Sales Order in Orca Distribution, at the agreed inter-company pricing.

- Orca Distribution ships the order to the retail customer.

IET then automatically generates a matching P/O Receipt & Invoice in Orca Sales, as well as a matching O/E Shipment & Invoice, which are emailed to the customer.

Show me the Money!

Orca R&D funds most of its operating costs through IP royalties:

- Orca Manufacturing calculates IP royalties payable to Orca R&D, based on production volumes for the reporting period, and enters A/P Invoices & Payments.

- These trigger IET to automatically generate the mirrored A/R Invoices & Receipts in Orca R&D.

Orca Sales is funded through a margin on product sales to its customers, while Orca Manufacturing and Orca Distribution are funded through margins on inter-company sales.

- IET facilitates the correct application of inter-company pricing by applying a pre-configured price multiplier to inter-entity sales from and to Sales, Distribution, and Manufacturing.

“We’re delighted that the productivity savings Orca Oz has made through the creative use of Inter-Entity Trade, together with other Orchid modules, has helped enable this growth.”

We wish them continued success and look forward to monitoring their progress in the coming years!