From our distant vantage point, where many people aged under 40 would never have seen a paper check, it can be hard to get our heads around the USA’s ongoing attachment to them as a mainstream payment method. We’ve touched on this topic in multiple articles, including “Is time up for the humble cheque?”.

The most recent stats we’ve found, from the US Federal Reserve Payment Study (FRPS 2022), reveal that from 2018 to 2021:

- Annual volumes, while declining by 7.2% per year, still came in at a staggering 11.2 billion checks.

- Despite that decline in volume, their total annual value increased marginally, to a gargantuan $27.23 trillion.

How did it come to this? Where is it heading, and when will it get there?

Why hasn’t the US taken the leap to fully digital payments, when many less advanced nations have done so? It doesn’t make much sense to us, which leads me to:

Shades of Grey…

Indulge me for a moment as we take a scenic detour. It still relates to checks, but of another type!

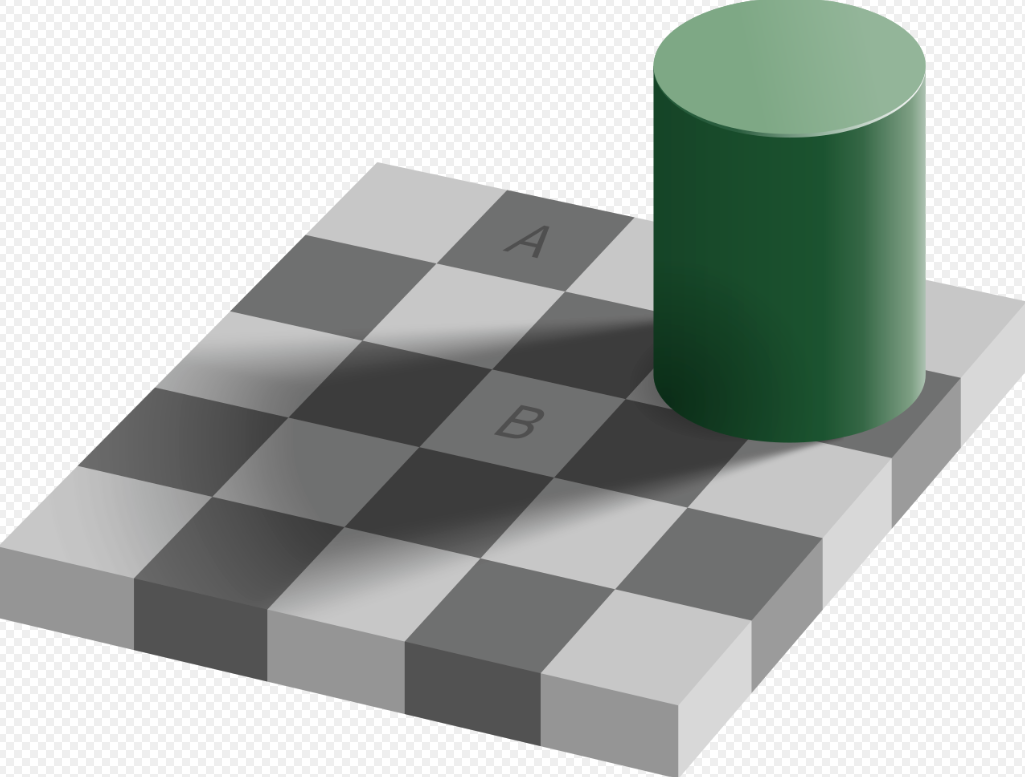

When mulling over this topic, and the head-scratching it evokes for an observer like me, my mind turned to a powerful illustration of cognitive dissonance that I recently stumbled upon. Let me introduce you to Edward H. Adelson’s “Checker Shadow Illusion”.

Examine the image below. What do you see? Focus on the squares marked A and B. What colour are they?

Answer: They are the exact same shade of grey! Unless you’ve seen this before the chances are you don’t believe me, but it’s true. You can find a proof and explanation here.

Even when you know it’s true, and understand how the illusion works, you still can’t quite get your head around it. You believe it, but you don’t see it! It made me think of Billy Joel’s song Shades of Grey, from his 1993 album River of Dreams.

Shades of grey wherever I go. The more I find out, the less that I know. Black and white is how it should be. But shades of grey are the colors I see.

Perhaps something similar is happening when we look at the resilience of US check payments in the face of a digital onslaught. We see it, but we don’t quite believe it. From our perspective, it’s black and white. Checks should have gone the way of the dodo by now.

What shades of grey are we missing?

A Checkered Past

How did we get here? Let’s take a brief history lesson on the development and evolution of paper checks for business-to-business payments in the USA.

- Early Trade and Barter: In the early days of commerce, transactions were primarily conducted through barter, the direct exchange of goods and services. As trade expanded and became more complex, a need arose for a more efficient and standardized method of payment.

- Introduction of Bills of Exchange: In medieval Europe, merchants began using bills of exchange as a form of credit and payment. These early documents were similar to modern-day checks, allowing merchants to transfer funds between different trading partners.

- Colonial America: In colonial America, businesses and individuals often relied on promissory notes and bills of exchange for financial transactions. These instruments helped facilitate trade and commerce in the burgeoning colonies.

- Banknotes and Clearing Houses: With the establishment of banks in the United States, paper-based instruments such as banknotes and drafts became more common. Clearing houses were established to facilitate the exchange and settlement of these instruments between different banks.

- The Rise of Checks: By the 19th century, paper checks had emerged as the preferred method of payment for many businesses. Checks offered a convenient and standardized way to transfer funds between accounts, reducing the need for cash transactions and improving security.

- Standardization and Regulation: Over time, the use of checks became more standardized, with the introduction of features such as MICR (magnetic ink character recognition) encoding to facilitate automated processing. The Uniform Commercial Code (UCC) provided a legal framework for check transactions, helping to ensure consistency and reliability in the banking system.

- Technological Advancements: In the late 20th and early 21st centuries, advancements such as electronic check imaging and Remote Deposit Capture (RDC) emerged. This allowed checks to be scanned into digital images and cleared electronically, removing the requirement of processing an actual physical check at a financial institution.

The last point may be particularly relevant. I’ll pick that up again in the Appendix at the bottom of this article.

Why the Inertia?

When we research the factors contributing to the continued use of checks for B2B transactions in the US, as opposed to Electronic Funds Transfer (EFT) and the like, the following are among those that come up:

- Legacy Systems and Processes: Where legacy accounting systems and processes have been set up to handle paper checks it can be difficult to justify the cost and effort needed to update them. (This is more of an issue for smaller businesses with modest budgets and relatively low transaction volumes.)

- Vendor and Supplier Preferences: Some vendors and suppliers may prefer to receive payments via checks due to familiarity, or because they lack the infrastructure to accept electronic payments. (Surely this can’t be common in 2024!)

- Perceived Security: Some may perceive checks to be more secure than electronic methods due to concerns about hacking, data breaches, or fraud. (Even if this isn’t objectively true!)

- Regulatory Compliance: Some businesses are subject to strict regulations regarding payment processing and record-keeping, and may feel that, for them, traditional paper-based methods make compliance easier. (No doubt others would feel that the opposite is true!)

- Infrastructure Challenges: In regions with limited internet connectivity, electronic payment systems may not be as reliable or accessible, making checks a more practical option.

That’s all well and good, but few if any of these barriers are unique to the US. So what’s going on?

What’s going on here?

Rather than asking “What’s different about the US?”, let’s turn that around and ask “What’s different about other countries?”

Why have smaller, supposedly less advanced countries managed to transition to fully digital payments, when the US hasn’t?

Here are some of the themes that emerge from the grey fog.

Cost & Scale:

- Running an efficient check processing and clearing regime doesn’t come cheap. These costs are generally born directly by governments and/or banks, and indirectly by customers.

- The key trigger point for the sponsors to pull the plug on checks is when this becomes unsustainable, through a combination of rising costs and falling volumes. (Our article on Singapore Joins the Cheque-Out Queue provides a good case study of this.)

For the USA I’m guessing that, even with declining volumes, the fees generated from $27 trillion in transactions puts them in a better position than others to bear these costs!

Interbank Collaboration:

- A slow and organic decline in volumes might impact banks differently, but a hard end date for the support of checks impacts them all. Each of them needs to manage the impacts on their customer base.

- Getting all banks in a country onto the same page for such a major change would be hard in any country, but it is far easier when there is a highly concentrated banking sector, with a few major banks dominating the market.

In many countries that have said goodbye to checks the number of banks is counted in double or low triple figures. In the US, the number of banks is in the thousands. I rest my case!

Culture & Regulatory Environment:

- A major change like exiting check payments would usually be initiated, implemented, and enforced by national regulatory authorities.

- The successful implementation of such a change would require a high degree of compliance from impacted banks, businesses, and consumers.

- Some countries achieve cooperation and compliance by negotiation. Other regimes are less concerned with societal buy-in and are happy to push through unpopular changes regardless.

With the US sitting towards the more libertarian end of the cultural spectrum, trying to push such a change through without buy-in is likely to end in tears.

For an example of what might go wrong, you need look no further than our “UK Case Study – A Cautionary Tale”, towards the bottom of our 2022 article.

Towards an Electric Future?

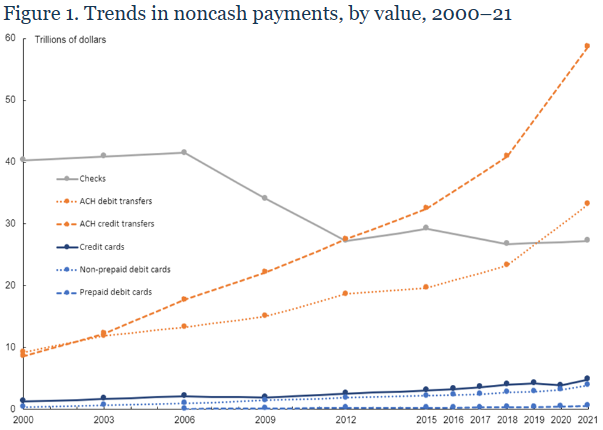

While the volume and value of checks in the USA mentioned at the start of this article made us shake our heads, the trend charts below, from the same 2022 FRPS summary, provide a different perspective:

- Figure 1 (Trend by Value): This shows that check payments appear to have plateaued at just under $30 trillion over the past decade.

- A huge number, certainly, but it is quickly being dwarfed by the rapidly rising value of electronic ACH (Automated Clearing House) payments, which has more than doubled over the same period.

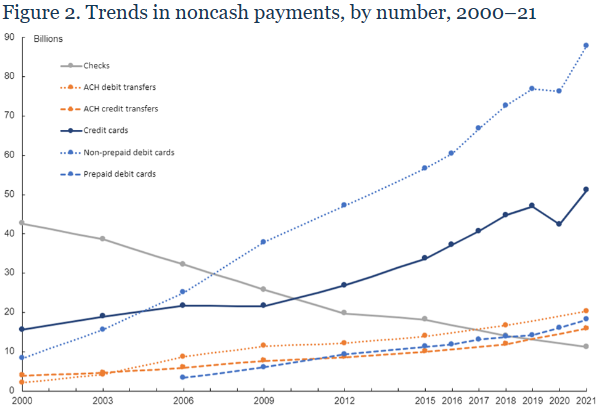

- Figure 2 (Trend by Volume): This makes the trend even clearer, notwithstanding that it includes consumer payments, and is dominated by the volume of smaller credit and debit card transactions.

- Over 20 years the “shade of grey” line representing check payments has slipped from runaway first to clear last and fading fast.

Picking winners is a risky business, but when it comes to picking losers, putting your house on checks looks to be a sure bet.

When asking if checks have a long-term future in the US, the answer might be black and white after all.

Where and when will it all end?

The “where” bit looks easy. The trend lines tell the story. There will come a day when paying for the infrastructure needed to support check payments becomes unsustainable, and the US will announce their demise, as sure as night follows day.

“When” is a harder question to answer. For the reasons outlined above, the US has little incentive to force a hard end date any time soon. The gain would not justify the pain.

We are likely to see several more years of organic attrition until that grey line in Figure 2 above starts bouncing off the floor of the chart. At that point, it will be clear that the market has made its choice, and the end game has become inevitable.

Would you like a date? OK, ask me again in five years!

Appendix: Fax Check!

I remember well how the emergence of fax machines as an indispensable business tool transformed the way documents were exchanged between remote locations in the 1980s. For me, that meant critical software crashes on client sites could be investigated and resolved far more quickly, with error logs faxed to our office within minutes rather than printed and couriered to us. Amazing!

I was intrigued years later when a colleague suggested fax machines may have set the digital revolution back by a decade or so. Their argument:

- Fax machines would take an analogue document, scan and digitize it for transmission over the phone line, then decode it at the receiving end to create an analogue “facsimile” of the original.

- My colleague saw this as a missed opportunity, having brought the possibility of end-to-end digital communications and data transfers almost within touching distance.

- They saw this as a halfway-house solution that just made the status quo more palatable. A "small step for man" that reduced the incentive for businesses to push for the logical next step, thereby delaying "a giant leap for mankind".

I’m not entirely convinced of the logic, but it makes me think. Has something similar happened with check payments in the US, and other ‘late mover’ economies like the UK?

Have advancements like Remote Deposit Capture removed the main pain points and made the processing of checks ‘good enough’ for many?

The last time I received a check in the mail was years ago, but I still recall that it meant a frustrating trip to the bank, and queueing to have it manually deposited into my account. Had I been able to snap an image on my smartphone and hit ‘deposit’ in my phone banking app, it wouldn’t have been a big deal.

Is it these incremental but significant usability improvements, never implemented in most other countries, that have delayed the demise of check payments in the US by a decade or more?

I suspect so. Of course, whether that’s a good thing or not will depend on your perspective.

What are you waiting for?

Even if the humble check is destined for a slow death in your country, there is no need to be the last one off the sinking ship.

You can join the thousands of businesses that have been taking matters into their own hands for years with Orchid’s EFT Processing. You can say goodbye to paper-based payments and enjoy the benefits today of improved efficiency, greater accuracy, and improved security.